The establishment is a nationwide service provider to many of the largest loan origination, servicing, and secondary entities. They provide a comprehensive range of services that can be applied across the loan origination process and servicing cycle. These services include valuations, REO (Real Estate Owned) asset management, property preservation, title and closing, and document management.

The outdated storage infrastructure caused loan processing delays, lacked disaster recovery safeguards, and couldn’t scale for AI workloads. These issues risked data loss, compliance gaps, and operational inefficiencies. This foundation was ill-equipped for the demands of a modern, data-intensive financial services provider.

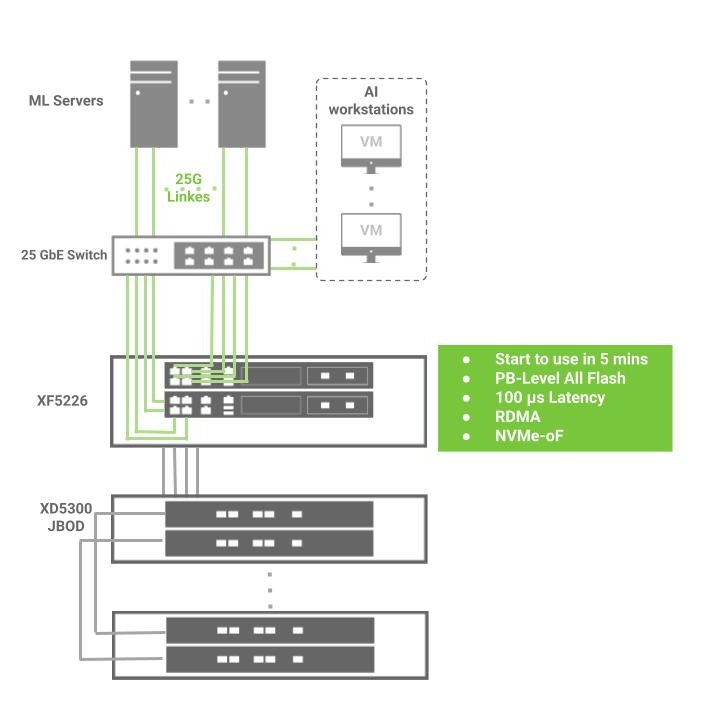

The nationwide mortgage leader eliminated aging infrastructure risks with QSAN’s XF5226 storage solution. By combining hybrid arrays, high-density JBODs, and all-NVMe flash storage, XF5226 enabled them to secure compliance, accelerate workflows, and scale for AI-driven growth across 50 states and U.S. territories.

In an industry where seconds matter and compliance is non-negotiable, the new storage infrastructure now thrives on 99% faster response for critical workflows with 400K IOPS sustained performance, a 1.2PB backup capacity with zero-data-loss SLA, and a modular architecture for nationwide growth with 99.999% uptime.

We’re here to help you find the best, most cost‑effective solution for your business.

Join the Future of Storage Tech – Subscribe in Seconds!